Knowing Your Company's Obligations Under the New SEC Rule on GHG Emissions

Register Today!

*The SEC has stayed implementation pending further court review.

On March 28, 2024 the Securities and Exchange Commission (SEC) published its long-awaited final rule on reporting of GHG emissions from a wide variety of publicly traded corporations. USEA is pleased to host this briefing with two of Deloitte Touche LLP’s experts on how the rule will affect publicly traded companies. The rule is to become effective May 28, 2024. Reporting is not required until 2026. The rule applies to both U. S. domestic public companies and foreign private issuers(?) (ADRs?).

The rule has been temporarily stayed by the US Fifth Circuit until further review. USEA’s briefing is offered to more fully inform the public of the contents and future reporting requirements of the rule in the event it becomes effective.

The USEA briefing will cover many important details including:

- Climate-related risks that have had or reasonably likely to have a material impact on the business strategy, results of operations, or financial condition;

- Actual and potential material impacts of any identified climate-related risks on the registrant’s strategy, business model, and outlook;

- Explanation of the covered emissions (Scope 1 and 2) and how indirect emissions or supply chains are not covered (“Scope 3”);

- How a registrant has undertaken activities to mitigate or adapt to a material climate-related risk, a quantitative and qualitative description of material expenditures incurred and material impacts on financial estimates and assumptions that directly result from such mitigation or adaptation activities;

- The capitalized costs, expenditures expensed, charges, and losses incurred as a result of severe weather events and other natural conditions, such as hurricanes, tornadoes, flooding, drought, wildfires, extreme temperatures, and sea level rise, subject to applicable one percent and de minimis disclosure thresholds, disclosed in a note to the financial statements;

- The capitalized costs, expenditures expensed, and losses related to carbon offsets and renewable energy credits or certificates (RECs) if used as a material component of a registrant’s plans to achieve its disclosed climate-related targets or goals, disclosed in a note to the financial statements;

- Anticipating how to explain to the public a company’s disclosure filings;

- Accounting standards for GHG emissions reporting; and

- Limited small company exclusion.

Who Should Attend:

- USEA members interested in public disclosure of emissions;

- Publicly traded companies in the U.S.;

- Foreign private parties affected by the new filing obligations;

- Public relations/external affairs communicators;

- SEC Compliance managers;

- EHS compliance managers; and

- Foreign companies seeking to align or explain this rule with GHG reporting compliance in EU, UK, Australia, Canada, India, Singapore, China, and Australia.

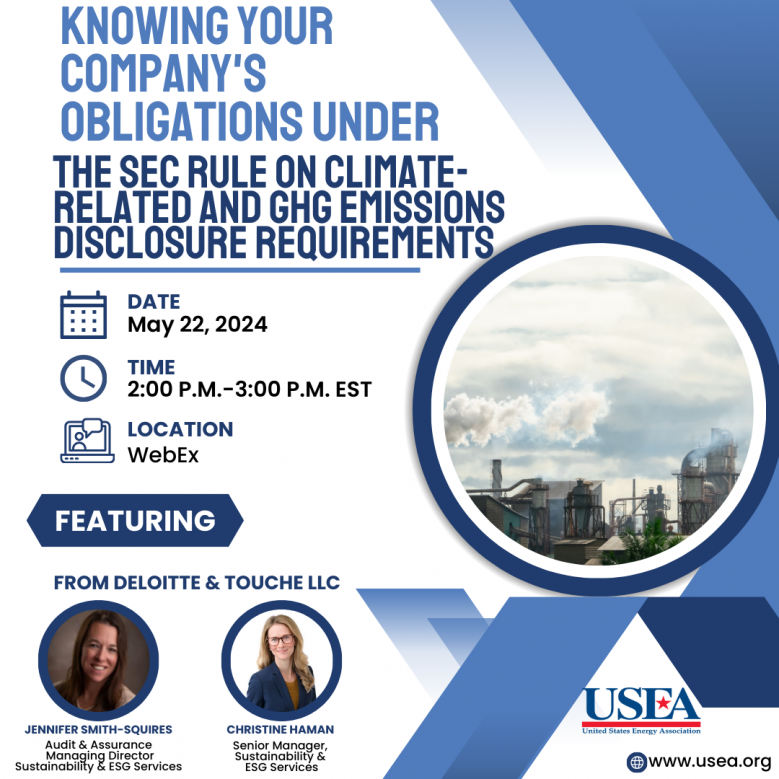

Speakers:

Christine Haman

Senior Manager, Sustainability & ESG Services;

Deloitte and Touche LLP

Jennifer (Jen) Smith Squires

Audit and Assurance Managing Director

Deloitte and Touche LLP