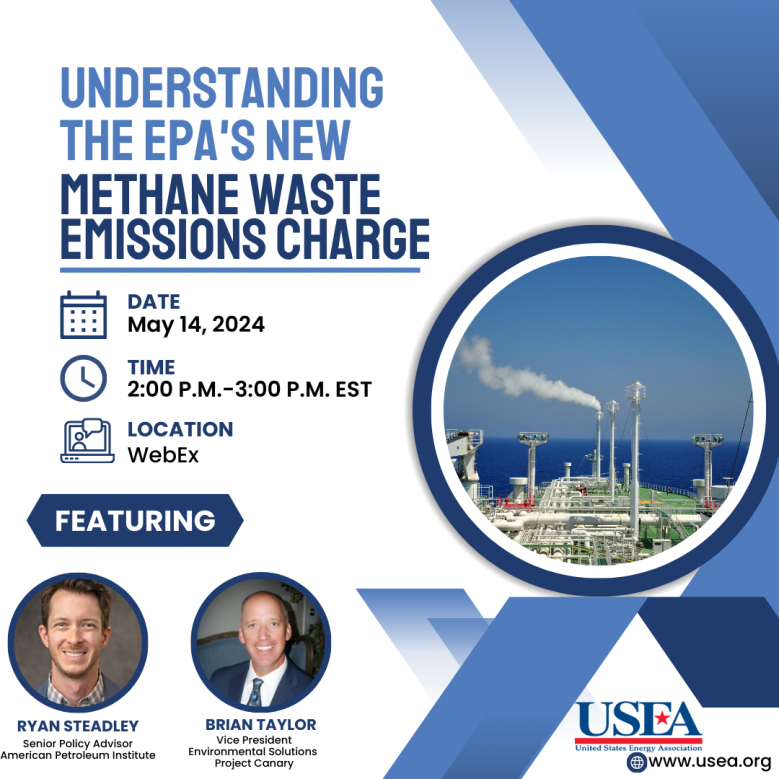

Understanding the EPA’s New Methane Waste Emissions Fee & Advanced Methane Leak Detection Technologies

Register Today

USEA’s remote briefing offers a terrific opportunity to get updated on methane, a greenhouse gas, and how a suite of federal and state regulations to reduce methane emissions will affect the energy supply chain including electricity produced by natural gas and natural gas feedstocks purchased by manufacturers. Whether you are an oil and gas company or an industrial consumer of electricity this meeting will help answer questions.

When Congress passed the Inflation Reduction Act (IRA) in 2022 it imposed a new fee on methane emissions. In August 2023 and January 2024 EPA issued two proposed rules to determine how this new methane fee will be assessed.

As prescribed by the IRA, for each ton of methane above a segment-specific “waste emissions threshold,” the applicable facility must pay $900 in 2025 for its excess 2024 emissions, with the charge increasing to $1,200 in 2026 for 2025 excess emissions and to $1,500 in 2027 and each year beyond for the preceding year’s excess emissions. There are many unique exemptions and variances to the application of this fee in the proposed rule which the speakers will help you understand.

Speakers:

- Ryan Steadley, Senior Policy Advisor, American Petroleum Institute (API) will give a primer on recent methane regulations affecting the energy supply chain from different federal agencies including EPA, DOT/PHMSA, and DOI/BLM. It is important to understand these regulations to comprehend how the new methane fee (tax) will be assessed.

- Brian Taylor, Vice President, Project Canary, will describe innovations in advanced technology and methodologies for detecting and quantifying methane emissions largely driven by company voluntary commitments and their anticipated role in the recent methane regulations.

Additional Information of Interest: